This topic shows user how to enter bank charges when received payment from debtor and make payment to supplier.

Below are the overall content for this topic:

Case 1

Example

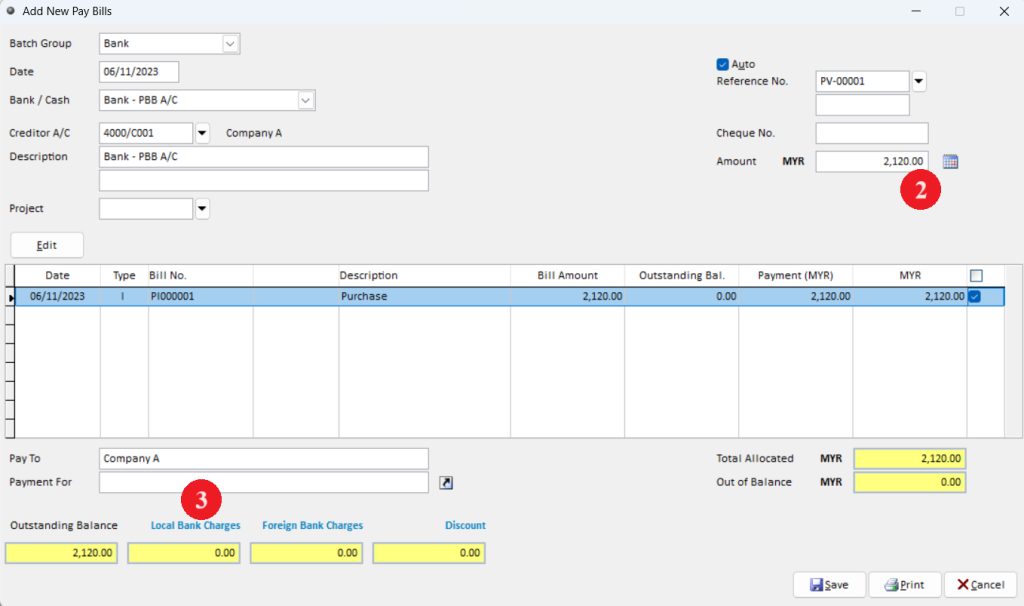

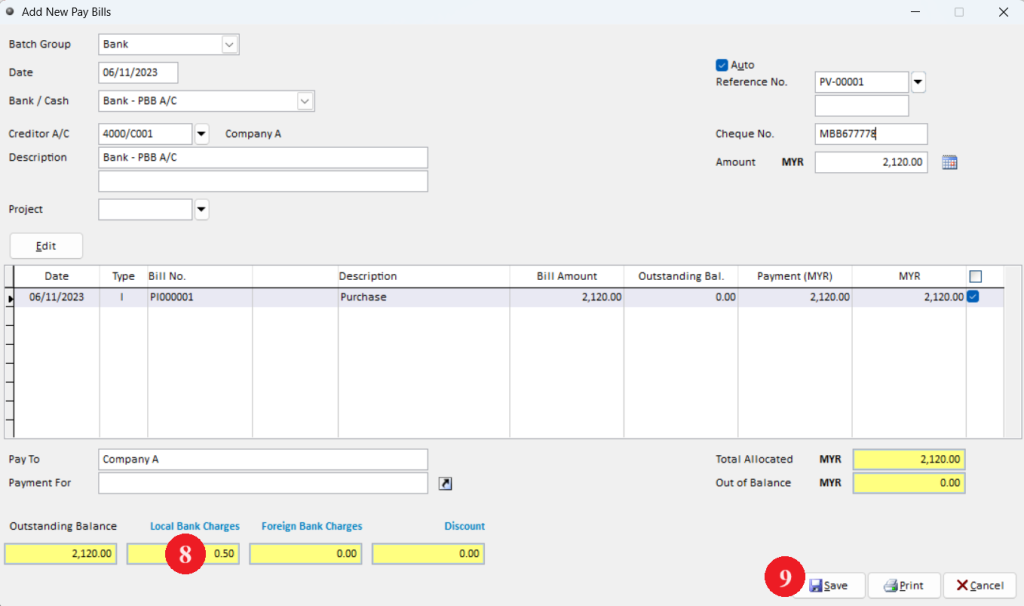

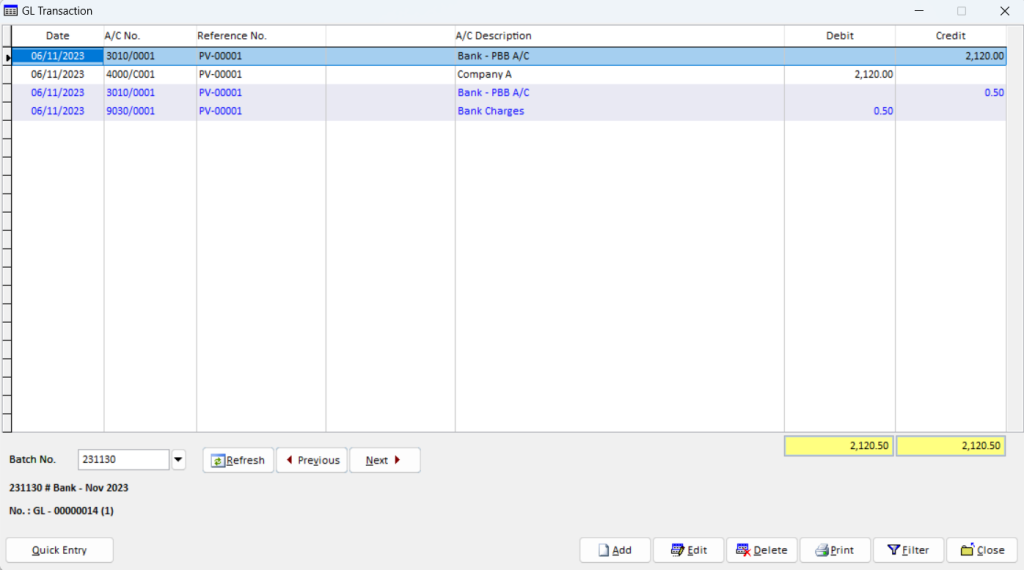

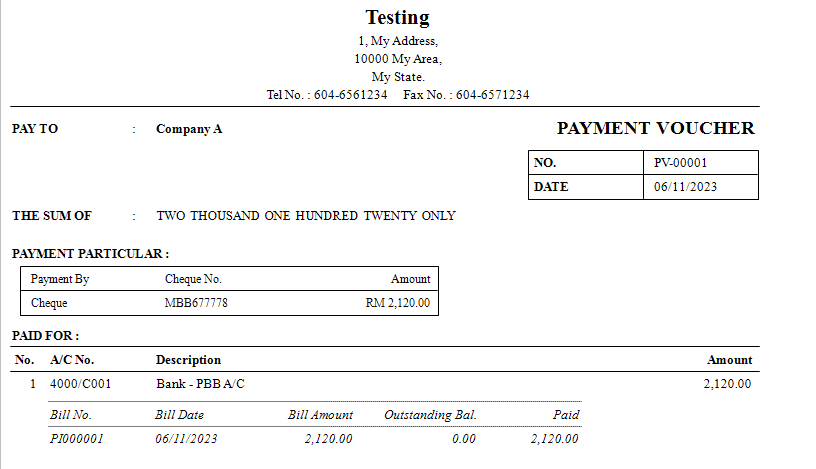

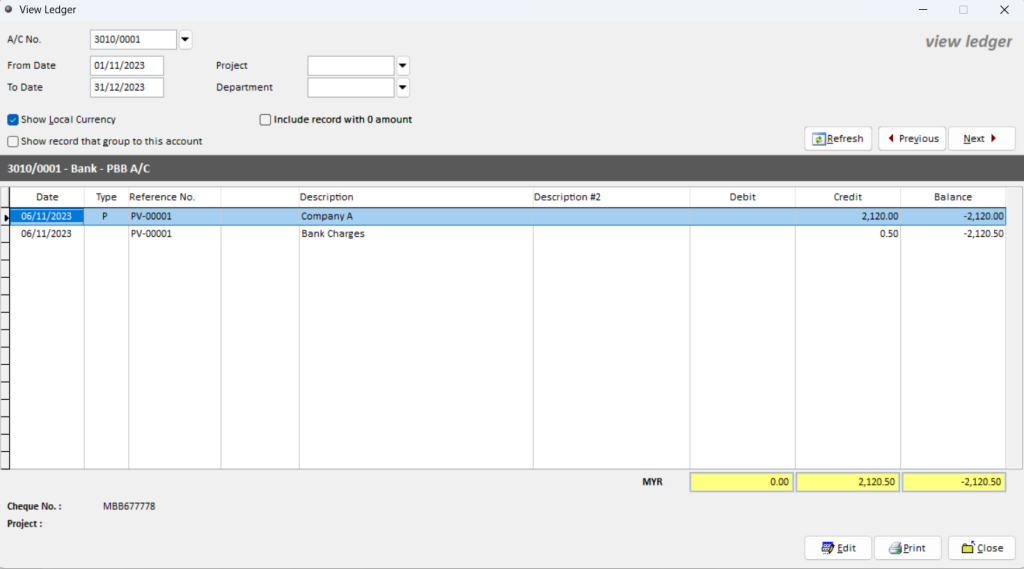

Total amount in purchase invoice is RM2,120. User is being charged RM0.50 by bank for cheque processing when make payment. The total amount credit from bank is RM2,120,50.

Step 1: Make payment to supplier with bank charges

Step 2: Print payment voucher

Step 3: View Ledger for bank

Case 2

Example

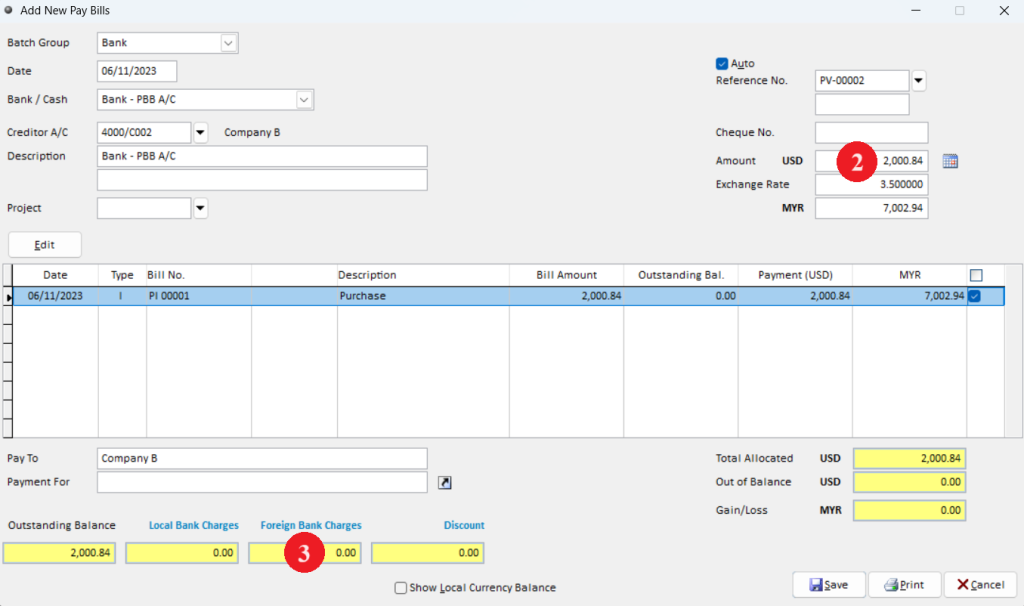

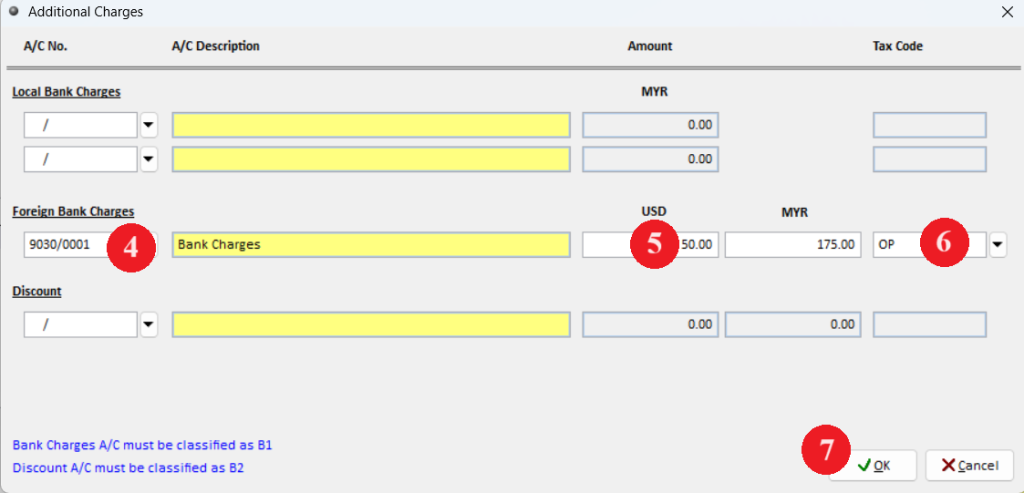

Total amount in purchase invoice is USD2,000.84 with exchange rate 3.40000. When user make payment, supplier ask for additional Telegraphic Transfer(T.T) charges USD50. The exchange rate is 3.5000 when made payment.

Step 1: Make payment to supplier with bank charges in foreign currency

Step 2: Print payment voucher

Step 3: View Ledger for bank

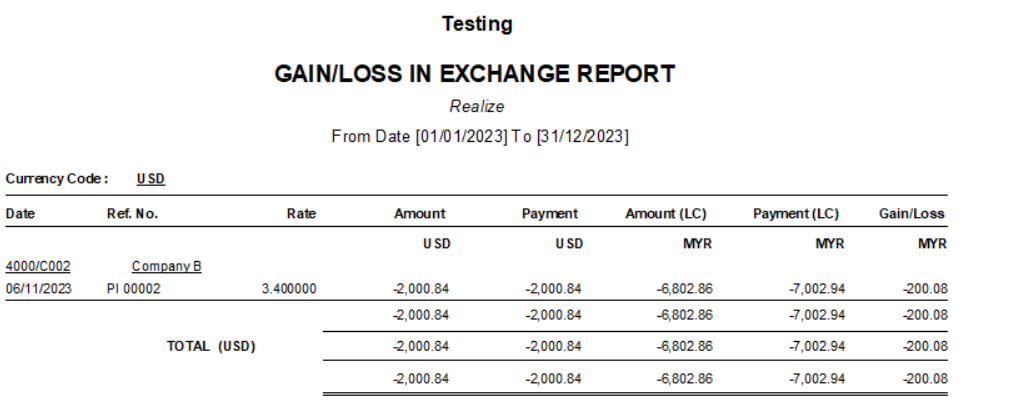

Step 4: Gain/Loss Report

Case 3

Example

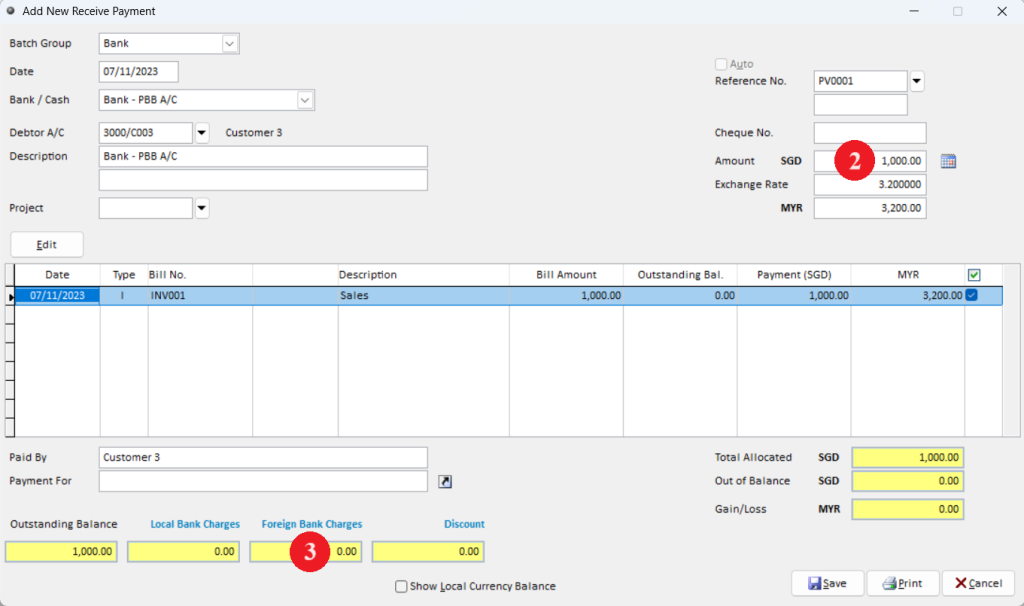

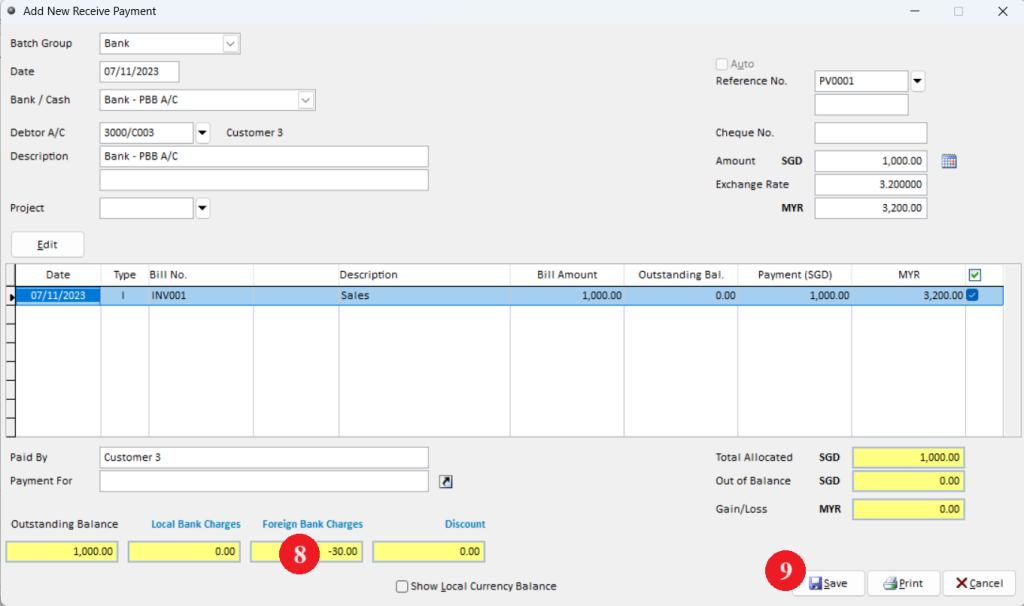

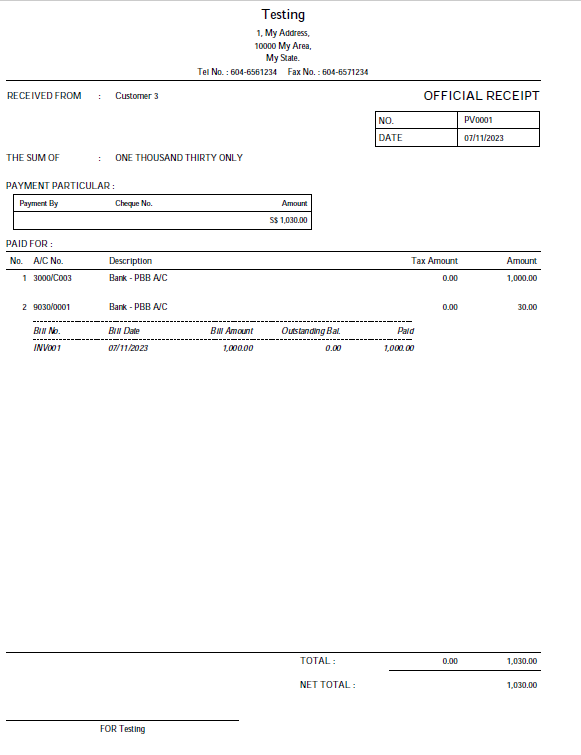

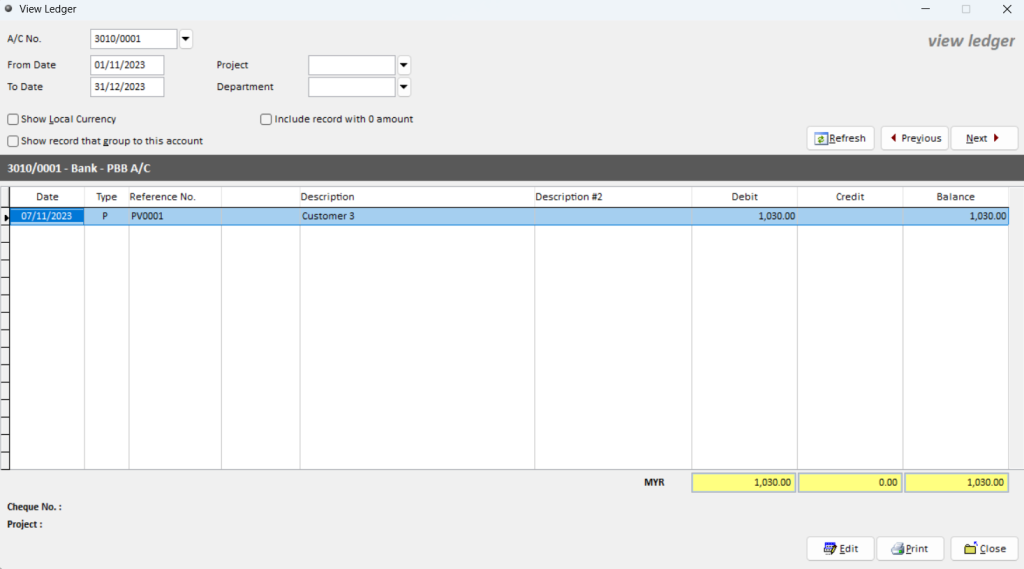

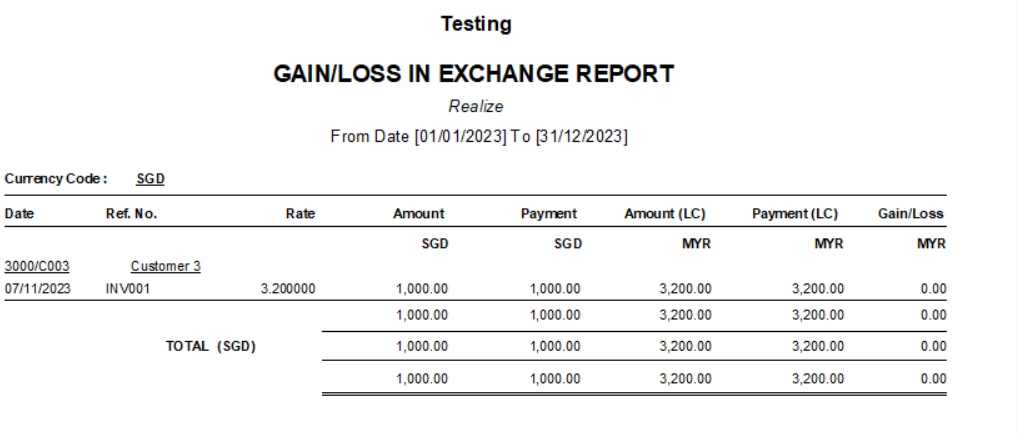

Total amount for sales invoice is SGD1,000 with exchange rate 3.10000. When customer make payment, user wanted to receive full amount SGD1,000 according to sales invoice without deduct T.T charges SGD30. Debtor need to pay SGD1,030 with the exchange rate 3.2000.

Step 1: Receive payment from debtor with bank charges in foreign currency

Step 2: Print offical receipt

Step 3: View Ledger for bank

Step 4: Gain/Loss Report

Case Example 1

Step 1: Make payment to supplier with bank charges

Step 2: Print payment voucher

Step 3: View Ledger for bank

Case Example 2

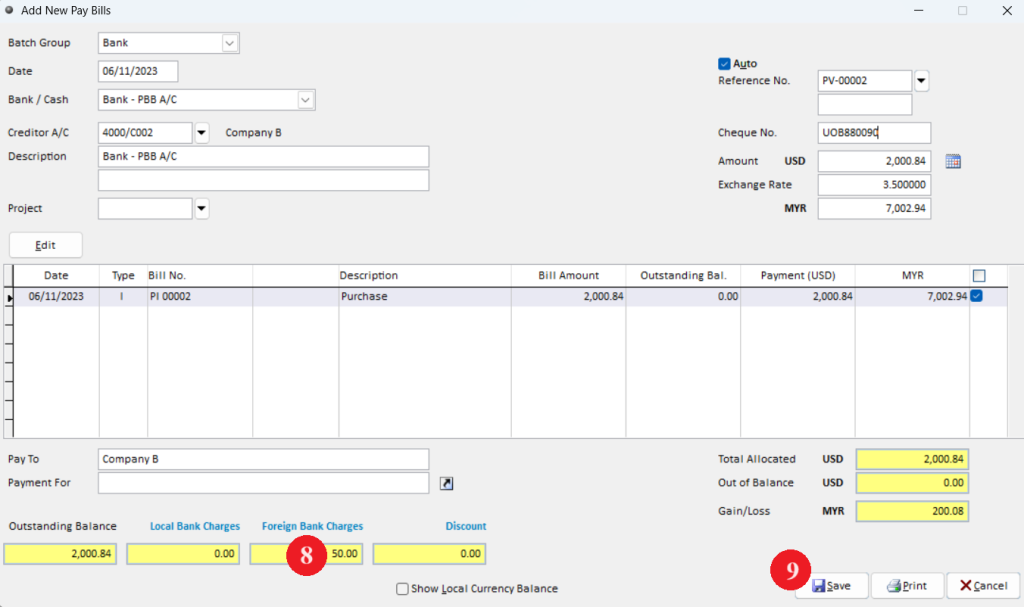

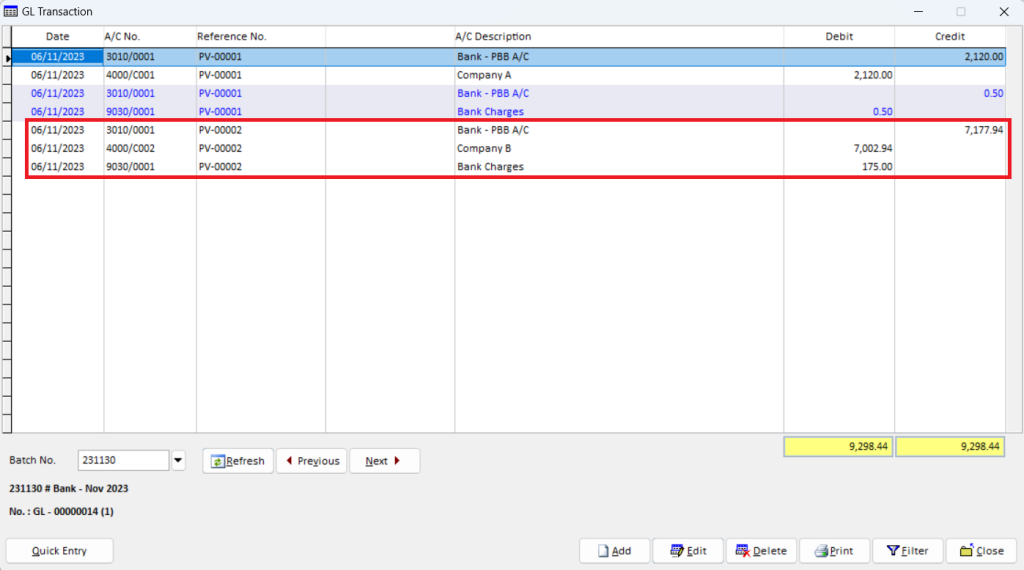

Step 1: Make payment to supplier with bank charges in foreign currency

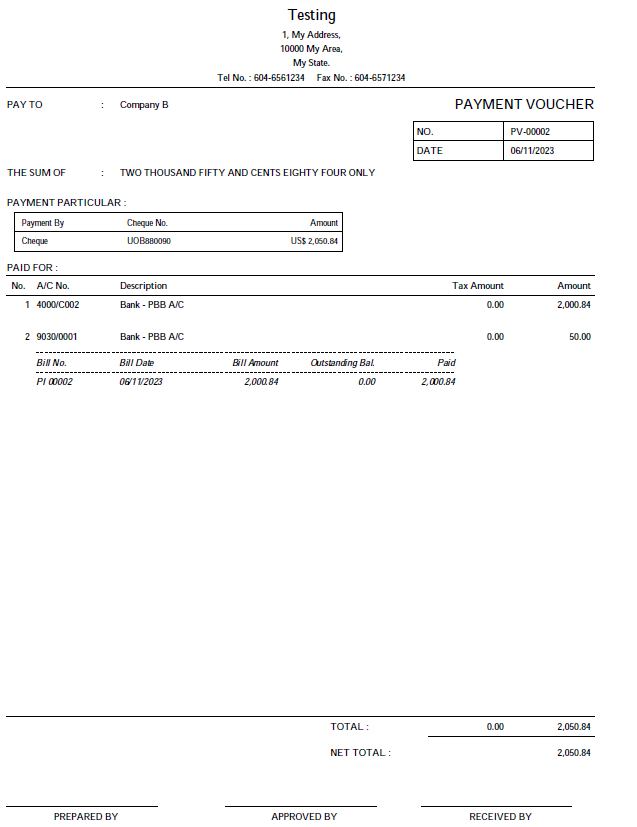

Step 2: Print payment voucher

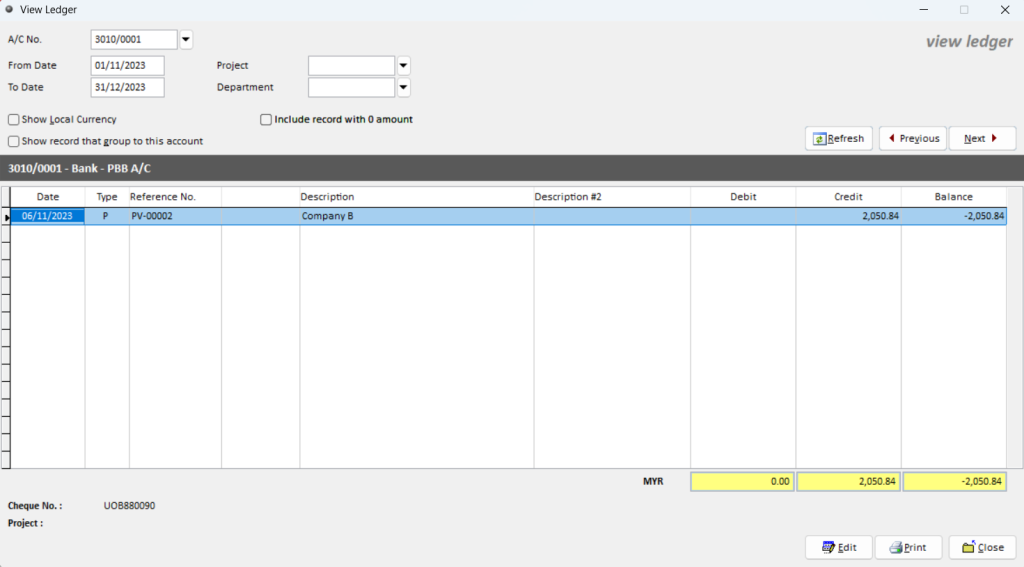

Step 3: View Ledger for bank

Step 4: Gain/Loss Report

Case Example 3

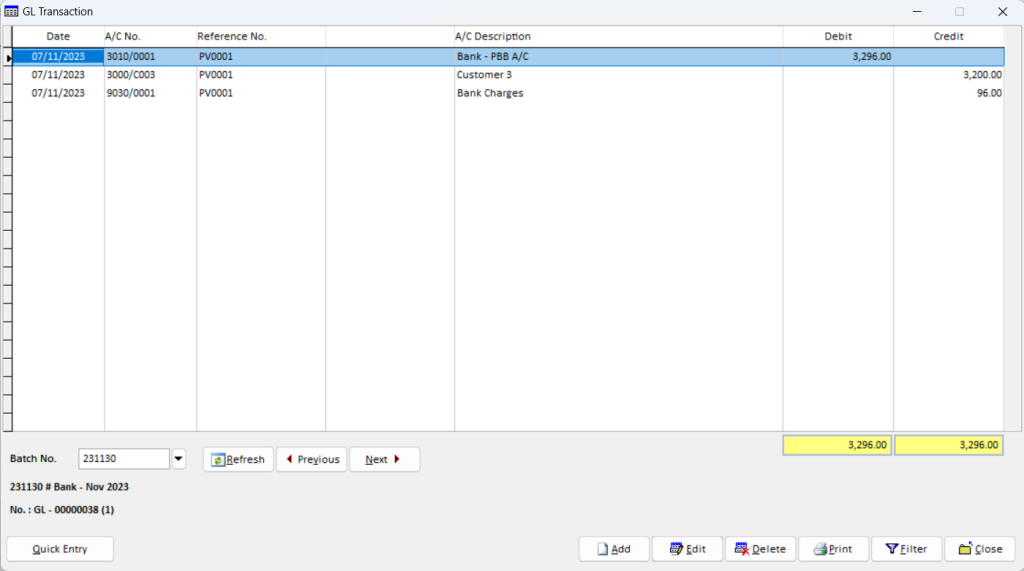

Step 1: Receive payment from debtor with bank charges in foreign currency

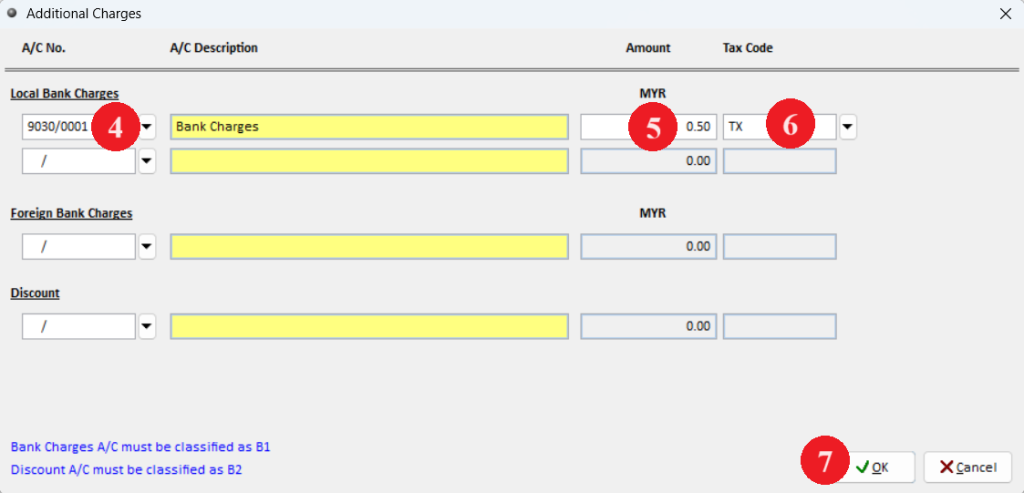

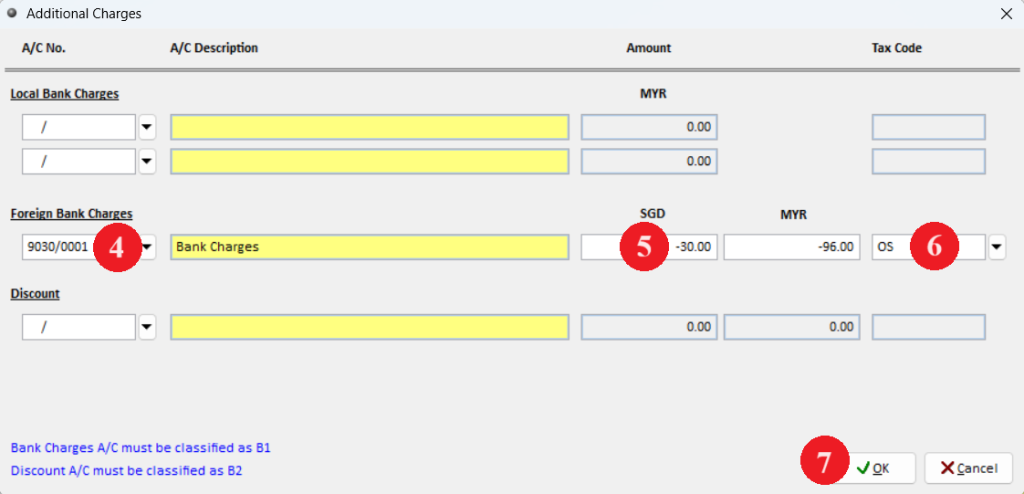

4. Select the bank charges account

NOTES: Ensure the bank charges account is being classified as B1 in GL account

5. Enter the amount (SGD30)

NOTES: If user enter SGD30 in foreign bank charges, user only received SGD970 and not SGD1,000 as being deduct for T.T charges.

6. Assign tax code for bank charges

7. Click OK

Step 2: Print offical receipt

Step 3: View Ledger for bank

Step 4: Gain/Loss Report

-

Million Account & Stock Help File

-

- Product

- Group

- Sub Group

- Brand

- Comment

- Recommended Price

- Promotional Discount

- Stock Location

- Opening Stock

- Serial No.

- Stock Receive

- Stock Issue

- Stock Adjustment

- Stock Transfer

- Stock Assembly

- Stock Enquiry

- Stock Reports

- Show Remaining Articles ( 2 ) Collapse Articles

-

- Add New Reference Number for Accounting

- Advance Search Function

- Asset Disposal

- Backup Reminder

- Backup Server Database from Workstation

- Bank Charges

- Change Key Code

- Cheque Return and Refund

- Closing Stock Value

- Contra Note

- GL Description

- Import GL Account From Other Company

- Import Item Into Sales Transaction

- Import Transaction Using Excel File

- Maintain Budget

- Process for Purchase Return

- Process for Recurring Invoice

- Credit Limit

- Credit Term

- Formula

- Hide Price Tip

- Hide Unit Cost

- Landing Cost

- Price Group Entry

- Multiple Delivery Address

- Bill of Material (BOM)

- Printing Approval

- Progressive Billing

- Send Invoice By Email

- User Group and Access Right

- Show Remaining Articles ( 15 ) Collapse Articles

-

- Articles coming soon

-

Million Payroll Help File

- Articles coming soon

-

Million Accounting Release Notes