E-invoicing Malaysia | LHDN E-invoice

Are you ready to adopt e-invoice?

What is e-invoice?

An e-Invoice, also called an electronic invoice, is like a digital receipt for a transaction between a seller and a buyer. It’s different from regular invoices because it’s digital, not on paper or in email, and includes important info like seller and buyer details, what was bought, and taxes. It’s made in a way that computers can understand easily.

- It's used to exchange invoice information between a seller and a buyer

- They are created, sent, received, processed, and stored using specific digital formats, making them easy to handle with software systems

- Unlike traditional paper invoices, LHDN e-invoices never exist in physical form; they're entirely digital

- An LHDN e-invoice is like a digital invoice.

Benefits of E - Invoice

-

Faster processing

Can be processed much faster than paper invoices, which can save businesses time and money.

-

Reduced costs

Eliminate the need for printing, mailing, and storing paper invoices, which can save businesses money on materials and postage.

-

Enhanced data security

Can be encrypted and stored securely, which helps to protect sensitive financial data.

-

Improved accuracy

Less prone to errors than paper invoices, which can help to reduce the risk of disputes and chargebacks.

Common Formats and Standards Use In Malaysia

E-invoicing uses standard formats to make invoices machine-readable, allowing for seamless data exchange between systems.

-

JSON (JavaScript Object Notation)

Lightweight data format for easy human and machine readability. Growing popularity in e-invoicing due to simplicity and compatibility.

-

XML (eXtensible Markup Language)

Versatile markup language for defining data structure in a human-readable format. Widely used in e-invoicing for its flexibility and ease of interpretation.

E - Invoice Implementation Timeline

Phased implementation of e-Invoice will be used to guarantee a smooth transition. The roll-out of e-Invoice has been carefully planned, taking into account the turnover or revenue levels, to provide taxpayers enough time to get ready for and adjust to the implementation of e-Invoice.

Targeted Taxpayers

Implementation Date

Taxpayers with an annual turnover or revenue of more than RM100 million

1 August 2024

Taxpayers with an annual turnover or revenue of more than RM25 million and up to RM100 million

1 January 2025

All taxpayers

1 July 2025

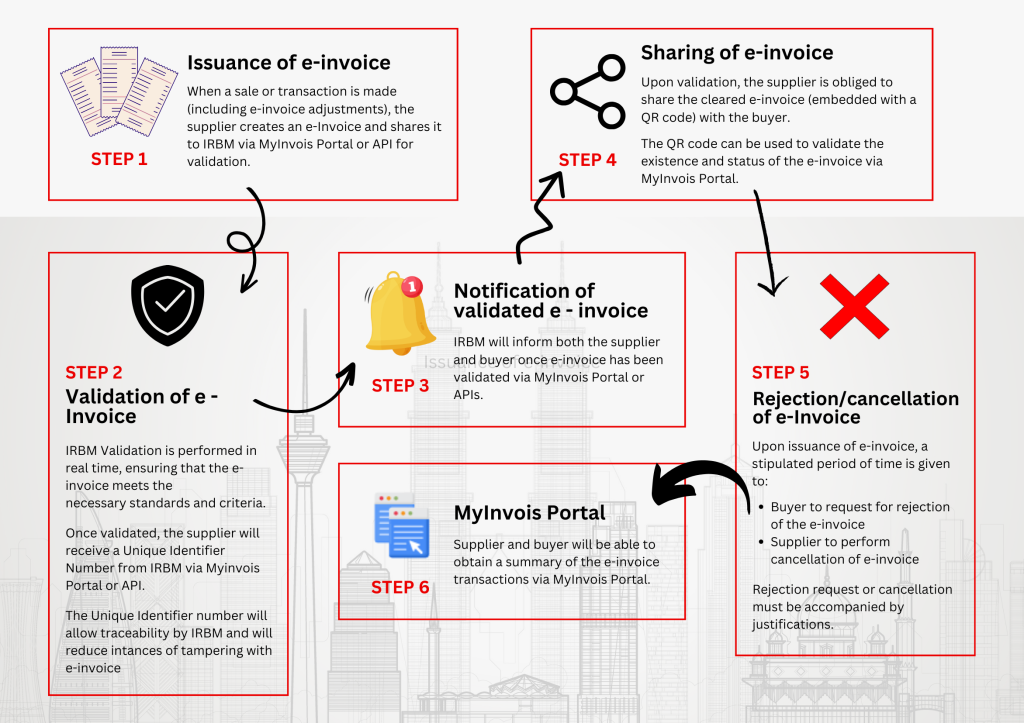

How e-Invoice actually works?

Who are the taxpayers in e-Invoice?

According to LHDN (Lembaga Hasil Dalam Negeri), the coming e-Invoice will apply to everyone involved in business activities in Malaysia. But who exactly is considered a taxpayer?

- Association

- Body of persons

- Branch

- Business trust

- Co-operative societies

- Corporations

- LLP

- Partnership

- Property trust fund

- Property trust

- REIT

- Trust body

- Unit trust

- Property trust fund

- Representative office and regional office

Overview of the e-Invoice Model

Taxpayers can choose the best method for sending e-Invoices to LHDN based on their unique circumstances and business needs, easing the transition to e-Invoice.

For the taxpayers’ choice, there are two (2) possibilities for the electronic invoice transmission mechanisms:

MyInvois Portal

- A portal hosted by LHDN

- Accessible to all taxpayers at no cost

- Also accessible to taxpayers who need to issue e-Invoice where Application Programming Interface (API) connection is unavailable

Application Programming Interface (API)

- An API is a set of programming code that enables direct data transmission between the taxpayers’ system and MyInvois system

- Requires upfront investment in technology and adjustments to taxpayers existing systems

- Ideal for large taxpayers or businesses with substantial transaction volumes

IPOH

E-Invoicing Classroom Training (FREE)

- 4th July 2024

- 9:30 a.m - 12:00 p.m

- English

- 231A, Jalan Pasir Puteh, Ipoh Perak 31560, Malaysia.

- Mr Low (014-967 2631)

E-Invoicing Classroom Training (FREE)

- 23rd July 2024

- 9:30 a.m - 12:00 p.m

- English

- 231A, Jalan Pasir Puteh, Ipoh Perak 31560, Malaysia.

- Mr Low (014-967-2631)

E-Invoicing Classroom Training (FREE)

- 8th August 2024

- 9:30 a.m - 12:00 p.m

- English

- 231A, Jalan Pasir Puteh, Ipoh, Perak, 31650, Malaysia

- Mr Low (014-967-2631)

E-Invoicing Classroom Training (FREE)

- 20th August 2024

- 9:30 a.m - 12:00 p.m

- English

- 231A, Jalan Pasir Puteh, Ipoh, Perak, 31650, Malaysia

- Mr Low (014-967-2631)

TAIPING

E-Invoicing Classroom Training (FREE)

- 9th July 2024

- 2:30 p.m - 5:00 p.m

- English

- No 3450, Tingkat 1, Jalan Chun Thye Phin Taiping Perak 34000, Malaysia

- Mr. Low (014-967-2631)

E-Invoicing Classroom Training (FREE)

- 31st July 2024

- 2:30 p.m - 5:00 p.m

- English

- No 3450, Tingkat 1, Jalan Chun Thye Phin Taiping Perak 34000, Malaysia

- Mr. Low (014-967-2631)

E-Invoicing Classroom Training (FREE)

- 13th August 2024

- 2:30 p.m - 5:00 p.m

- Language

- No 3450, Tingkat 1, Jalan Chun Thye Phin Taiping Perak 34000, Malaysia

- Mr. Low (014-967-2631)

E-Invoicing Classroom Training (FREE)

- 28th August 2024

- 2:30 p.m - 5:00 p.m

- English

- No 3450, Tingkat 1, Jalan Chun Thye Phin Taiping Perak 34000, Malaysia

- Mr. Low (014-967-2631)

Learn more about what is different between e-invoice and e-invoicing? Click here

Frequently Asked Questions

No, e-Invoice is applicable to both domestic and cross-border transactions. The cross-border transactions include import and export activities.

For clarity, the compliance obligation is from the issuance of e-Invoice perspective. In other words, taxpayers who are within the annual turnover or revenue threshold as specified in Section 1.5 of the e-Invoice Guideline are required to issue and submit e-Invoice for IRBM’s validation according to the implementation timeline.

IRBM is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified stakeholders to provide comprehensive information regarding the implementation of e-Invoice in Malaysia including:

- Sharing the planning of action plans, strategies, and status developments regarding the implementation of e-Invoice; and

- Obtaining feedback and views through two-way communication between IRBM and taxpayers on the implementation of e-Invoice.

IRBM will adopt the Continuous Transaction Control (CTC) Model where the validation is done in near real-time by IRBM.

Yes, all businesses will be required to issue e-Invoice in accordance to the phased mandatory implementation timeline, which is based on the business’ annual turnover or revenue threshold.

Suppliers are required to obtain buyer’s details from the foreign buyers for the purposes of e-Invoice issuance.

In relation to TIN to be input in the e-Invoice, supplier may use “EI00000000020” for foreign buyers without TIN. Refer to Section 10.5 of the e-Invoice Specific Guideline for further details.

IRBM validation includes a series of checks to ensure the

e-Invoice submitted to IRBM conforms to the e-Invoice format and data structure as specified by IRBM. Refer to section 2.4.3 of the e-Invoice Guideline for further details.l.

Yes, a refund note e-Invoice is required for return of monies to buyers, with the following exception:

- Payment made wrongly by buyers

- Overpayment by buyers

- Return of security deposits

An e-Invoice may be required for disbursements and reimbursements, subject to the situation. Refer to Section 5 of the e-Invoice Specific Guideline for further details.

No, LHDN e-invoice is not limited to transactions within Malaysia. It is applicable toboth domestic and cross-border transactions, which include import and export activities.

For any queries regarding the LHDN e-invoice implementation in Malaysia, kindlysend an email to [email protected]

All taxpayers, including companies, must implement LHDN e-invoice based on their

annual turnover or revenue as reported in the FY22 Audited Financial Statements.

Currently, no specific industries are exempt from LHDN e-invoice implementationinMalaysia. However, certain individuals, types of income, and expenses may beexempted; details are available in Section 1.6 of the LHDN e-invoice Guideline.

All Malaysian businesses must issue LHDN e-invoices based on a phasedimplementation timeline linked to their annual turnover or revenue threshold, facilitating a smooth transition for businesses of varying sizes.

Yes, there is a 72-hour timeframe for the supplier to cancel the LHDN e-invoice

Yes, a Software Development Kit (SDK) will be provided to facilitate systemintegration

To issue an LHDN e-invoice to foreign buyers without a TIN (Taxpayer IdentificationNumber), suppliers should obtain the buyer’s details.

If a TIN is required, but the foreign buyer lacks one, suppliers can use theplaceholder “EI00000000020.”

Suppliers have no specific timeframe for LHDN e-invoice adjustments and can followtheir company policies.

Foreign suppliers and buyers, not using the MyInvois System, make adjustments through specific LHDN e-invoices like debit notes, credit notes, or refund notes

Yes, the supplier will be able to create LHDN e-invoice in draft or proforma. LHDNeinvoice will only be accepted for tax purposes once the validation is successful.

No, the supplier cannot edit LHDN e-invoice information after it has been verifiedbyIRBM.

If changes are needed, the supplier should cancel the LHDN e-invoice within 72 hours from the time of validation and reissue a new LHDN e-invoice or use a debit note, credit note, or refund note LHDN e-invoice to adjust the original LHDN e-invoice.

After 72 hours from the time of validation, a new LHDN e-invoice must be issuedtomake any changes.

IRBM validation includes a series of checks to ensure the LHDN e-invoice submitted to IRBM conforms to the LHDN e-invoice format and datastructure as specified by IRBM. Refer to section 2.4.3 of the LHDN e-invoice Guidelinefor further details.

An LHDN e-invoice may be necessary for disbursements and reimbursements depending on the situation.

Yes, a refund note LHDN e-invoice is required for returning money to buyers unless the payment was made in error by buyers, there was an overpayment by buyers, or it involves returning security deposits.