What is EPF?

- Government Mandatory Deposits and Retirement Funds

- Usually 13% for the boss and 11% for the employee (adjusted annually)

Example: Salary of RM2,000 for an employee

| The employer needs to pay | RM260 |

| The employee needs to pay | RM220 |

| The employee actually only gets the salary of RM1780 | |

| The employer needs to pay the government | RM480 |

What doesn’t need to be given to EPF?

- Salary

- Payment for unutilized annual or medical leave

- Bonus

- Allowance

- Commission

- Incentive

- Arrears of wages

- Wages for maternity/ Study/ Half day leave

- Other payments under services contract or otherwise

What doesn’t need to be given to EPF?

- Service charges include Tips

- Overtime payment

- Gratuity (payment to employee payable at the end of a service period or upon voluntary resignation)

- Retirement benefits

- Retrenchment, temporary and lay-off termination benefits

- Travelling allowance or the value of any travelling concession

- Payment in lieu of notice of termination of employment

- Director’s fee

- Gifts, including cash payments for holidays like Hari Raya, Christmas, etc.

- Benefits-in-kind and nonmonetary perquisites

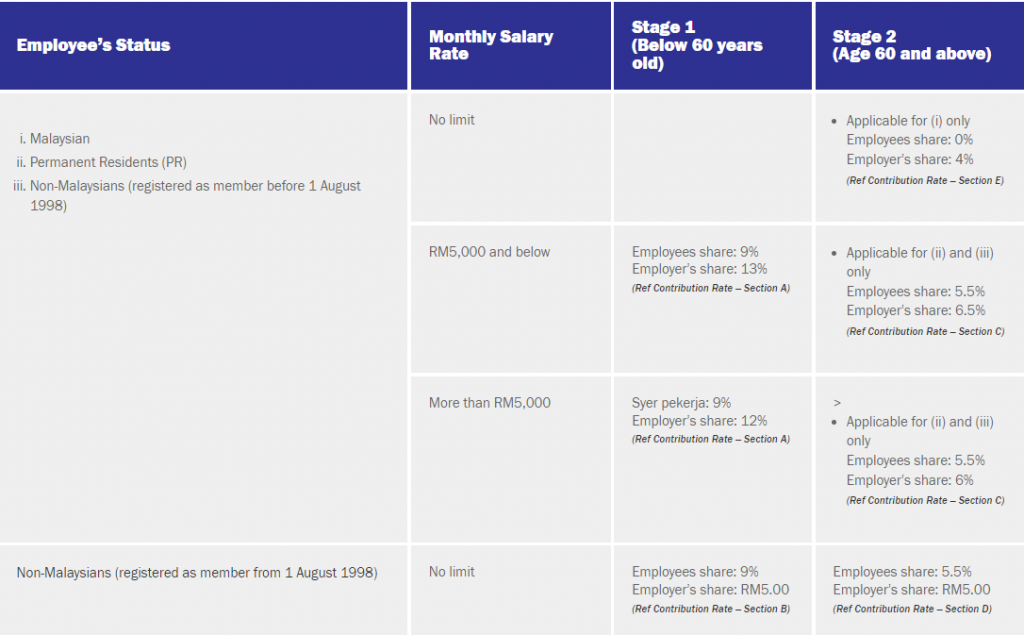

EPF Contribution Rate Malaysia as of Year 2021

EPF Contribution Rate 2021

Reminder :

The calculation of the contribution amount must follow the

Third Schedule of the EPF Act 1991. Also, try not to use the exact percentage for the contribution rate, except for those who have salary of more than RM20,000.

Source From: https://www.kwsp.gov.my/employer/contribution/all-about-your-responsibility

Find us on google – Click here

For More Knowledge & Articles – Learn More