[vc_row][vc_column][vc_tta_accordion][vc_tta_section title=”Account” tab_id=”1541398866643-75a8e4ee-ea97″][vc_toggle title=”Can I transfer my UBS data to Million Accounting System?”]Yes, you can transfer all data from UBS Accounting System to Million Accounting System.[/vc_toggle][vc_toggle title=”How to Record Hire Purchase Motor Vehicle?”]Example 1:

Motor Vehicle ABC XXXX cost = RM 238,446.00

Insurance = RM 7,842.35

Loan from Bank = RM 200,000

Loan from Director = RM 41,288.75

Deposit = RM 5,000

Hire Purchase Interest Suspense = RM 32,480.00

| 1.) To Record Deposit Paid | ||

| Dr. Deposit Paid (Current Assets) | RM 5,000.00 | |

| Cr. Bank (Current Assets) | RM 5,000.00 | |

| 2.) To Update Hire Purchase of Motor Vehicle | ||

| Dr. Motor Vehicle – ABC XXXX (Fixed Asset) | RM 238,446.40 | |

| Dr. Road Tax & Insurance (Expenses) | RM 7,842.35 | |

| Cr. Deposit Paid (Current Assets) | RM 5,000.00 | |

| Cr. Amount Owing to Director (Current Liabity) | RM 41,288.75 | |

| Cr. Hire Purchase – ABC XXXX (Current Liability) | RM 200,000.00 | |

| 3.) To Updated Hire Purchase Interest in Suspense |

||

| Dr. HP Interest in Suspense – ABC XXXX (Negative Current Liability) | RM 32,480.00 | |

| Cr. Hire Purchase – ABC XXXX (Current Liability) | RM 32,480.00 | |

[/vc_toggle][vc_toggle title=”Balance Forward Customers vs. Open Item Customers”]

Balance Forward Customers vs. Open Item Customers

| Open Item (Knock Off Basis) | Balance Forward (Without Knock Off) | |

| Definition | Individual transaction information is saved and detailed on customer statements until the transaction is removed through paid transaction removal. | Transaction information is retained only for the current period and is then consolidated into an account total that is brought forward at the beginning of each subsequent period. |

| Number of aging periods | You can use up to seven againg periods. | There are only two aging periods, current and noncurrent. |

| Finance Charge | Accounts are aged before assessing finance charges because open item accounts are aged by individual transaction dates. | Accounts are consolidated after finance charges are assessed and statements have been printed because balance forward accounts don’t retain individual transaction information. |

| Aging | Open item aging can be done at any time of the month by initiating the aging process. | Balance forward consolidation occurs during the paid transaction removal procedure. |

| Cash receipts/posted transactions | Payments can be applied to specific invoices. You will be able to waive finance charges, assess charges for non-sufficient funds (NSF) checks and void transactions until you’ve completed the paid transaction removal procedure. | Payments are applied automatically to the current balance. You will be able to waive finance charges, assess charges for non-sufficient funds (NSF) checks and void transactions until you’ve consolidated the accounts during the paid transaction removal procedure. |

| Multicurrency transactions | Multicurrency transactions can be entered for open item customers. | Multicurrency transactions can’t be entered for balance forward customers. |

[/vc_toggle][/vc_tta_section][vc_tta_section title=”General” tab_id=”1541398866660-62046330-e230″][vc_toggle title=”Costing Method during Excel Migration”]

The Code are as follow:-

| Item Type | S | S | S | V |

| Costing Method | A | F | S | S |

| Result | Average | FIFO | FIXED | Service Item |

Remarks: Item Type code is; Stock item = “S”, Service Item = “V”

[/vc_toggle][vc_toggle title=”How to set access right for each user?”]

There are 2 alternative for you to set the user rights

a) Only certain menu user can access.

b) All menus can access except for following menu.

On the Access Rights tree list, find the access right you want to grant, then tick the menu you would like to add to, then click save button.

On the Access Rights tree list, find the access right you don’t want to grant, then tick the menu you would like to add to, then click save button.

[/vc_toggle][vc_toggle title=”Can I transfer my master data from other stock system?”]

Yes, you can transfer your master data such as customer, supplier & product listing to Million Software as long as you can export your data to excel format.

|

Listing Import

|

UBS Inventory System

|

Other Stock System

|

Newly Implement

|

|

Customer

|

Yes

|

Yes

|

Yes

|

|

Creditor

|

Yes

|

Yes

|

Yes

|

|

Product

|

Yes

|

Yes

|

Yes

|

|

Product Group

|

Yes

|

Yes

|

Yes

|

|

Product Sub-Group

|

Yes

|

Yes

|

Yes

|

|

Product Brand

|

Yes

|

Yes

|

Yes

|

|

Product Location

|

Yes

|

||

|

Outstanding Bill & Amount

|

Yes

|

Yes

|

Yes

|

|

Opening Stock Qty

|

Yes

|

||

|

Historical Price Record

|

Yes

|

||

|

Customer Recommended Price

|

Yes

|

||

|

Supplier Recommended Price

|

Yes

|

||

|

Agent

|

Yes

|

||

|

Project

|

Yes

|

[/vc_toggle][vc_toggle title=”Million How to Set Accounting & Stock Opening Date?”]

To set accounting & stock date:

{Go to} System => General Setup

1. Account Opening Date:This date use to set account opening balance & last year figure.

2. Account Ended Date: Also call as cut off date. This date use for year ended closing.

3. Stock Opening Date: This date set for stock opening date. Some company may start using million stock control system at the mid of the accounting period.

[/vc_toggle][vc_toggle title=”Why Million Report Cannot Export to Excel”]

[/vc_toggle][vc_toggle title=”Why Million Report Cannot Export to Excel”]

Million Software only support Microsoft Office Tools Home Premium Edition & Above.

Million Software export to excel NOT support Microsoft Office Excel (Started Edition)

[/vc_toggle][vc_toggle title=”How does GST Compliant Accounting Software help your busines”]

With a GST Compliant Accounting Software, yur company will be able to submit the GST form on time and with less human errors.This software can produce a accurate GST Form facilitating all required informations on the total amount payable or claimable from your local authorities. Timely submission and payments will protect you from unnecessary penalties or even excessive fine.

[/vc_toggle][/vc_tta_section][vc_tta_section title=”Installation” tab_id=”1541399404554-28090280-1e71″][vc_toggle title=”The SQL Server service failed to start”]

- SQL Server needs administrative permissions to create registry entries and to create services.

- The firewall on the system might be blocking the installation.

- Application Log files in the Event viewer is full. Increase the size of the Log files.

- The SQL 2005 express edition does not support following processors AMD K6-2 processors, AMD Phenom 8400 Triple-Core processor, And Intel Xeon X5680.

- Required prerequisites for SQL Express 2005 may not be there in system.

- Antivirus on the system might be blocking the installation.

|

Solution 1:

Navigate to “C:\Documents and Settings\NetworkService\Application Data\Microsoft” and Give full control permissions to “EVERYONE” for Protect folder.

|

|

Solution 2:

Make sure that you are running the SQL Server setup as “Run as Administrator”.

|

|

Solution 3:

During SQL Server installation choose “Local System” for Service account.

|

|

Solution 4:

Need to create an “empty” registry key name as ‘Domain’ in this path

“HKLM\SYSTEM\CurrentControlSet\Services\Tcpip\Parameter”.

Start > run > type regedit

Navigate to this registry “HKLM\SYSTEM\CurrentControlSet\Services\Tcpip\Parameter”

Right Click “Parameter” > New > String Value > rename as “Domain”

|

|

Solution 5:

Don’t click on cancel, let that error message be on screen, try to rename “Microsoft” folder in the below path.

“C:\Documents and Settings\NetworkService\Application Data\Microsoft”

|

|

Solution 6:

Switch OFF the “Firewall” and “Antivirus” till installation finishes.

|

|

Solution 7:

Start > Run > eventvwr.msc > Right click Application > Properties > Change maximum log size to bigger value. And Check “Overwrite events when needed”.

|

|

Solution 8:

Don’t click on cancel, let that error message be on screen,

Grant Full rights to “NETWORK SERVICE” on the “C:\Documents and Settings\NetworkService” folder

|

|

Solution 9:

.NET Framework 2.0 SP1 and Windows Installer 3.1 must be installed in this system.

|

|

Solution 10:

Let the error message be on the screen, Transfer [SqlOS.dll and SqlServr.exe of SqlFix] to SQL installation path [C:\Program Files\Microsoft SQL Server\MSSQL.1\MSSQL\Binn] and click OK.

Download: SqlFix

|

|

Solution 11:

The SQL 2005 family does not support following processors AMD K6-2 processors, AMD Phenom 8400 Triple-Core processor, And Intel Xeon X5680.

|

[/vc_toggle][/vc_tta_section][vc_tta_section title=”Payroll” tab_id=”1541399468440-de6dfc18-7239″][vc_toggle title=”Can Million Generate e-PCB Data?”]

INTRODUCTION

Attention: This system will store only validated, PASSED and confirmed submission PCB/CP38 data.

FPX PAYMENT

e-Data PCB users can choose to pay their PCB either through online by using FPX Services or at the payment counter of Inland Revenue Board Malaysia at Jalan Duta, KL, Kuching and Kota Kinabalu.

The FPX service is provided by these banks :

The payment received date is the payment date through FPX.

The payment received date is the payment date through FPX.

The slip bank is an acknowledgement receipt of payment by the employers.

The slip bank is an acknowledgement receipt of payment by the employers.

Source: https://eapps.hasil.gov.my/?&lang=en

Million Payroll can generate CP 39 text file support to e-PCB Data.

[/vc_toggle][vc_toggle title=”How to Generate EA Form Using Million Payroll?”]

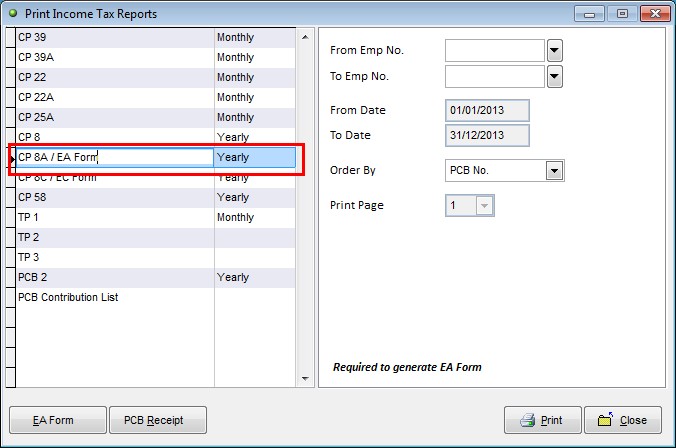

Click HERE to download the notes on How to Generate EA Form Using Million Payroll?

Please obtained the password for the access right of the notes from KMS Software Solutions Sdn Bhd, the password only provide to KMS Software Solutions Sdn Bhd’s Customers.

[/vc_toggle][vc_toggle title=”How to Count Days Worked Using Million Payroll System?”]

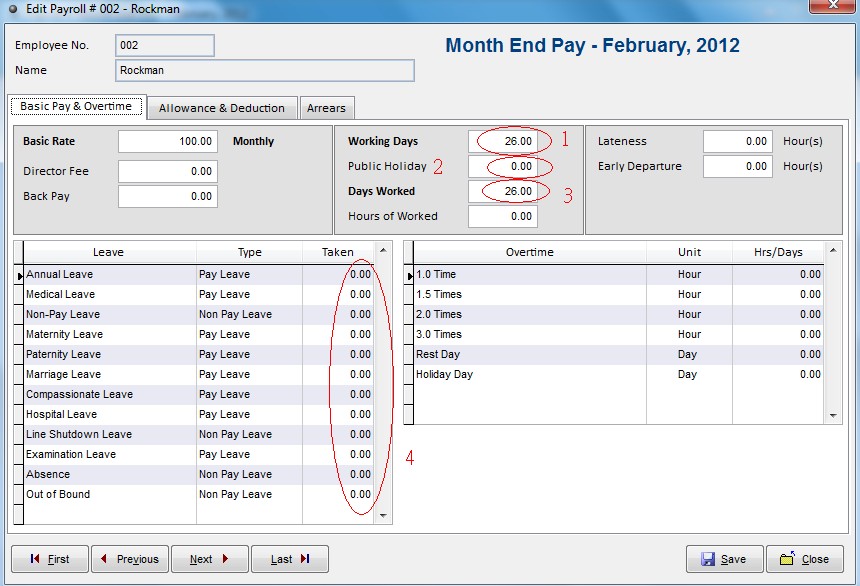

Million Payroll System will automatically calculate payroll for the user,

Therefore the user only need to key in following details:-

=> Part 2: Public Holiday

=> Part 4: Pay Leave and Non-pay leave Taken

The Calculation will be as follow:

”Days Worked“ = “Working Days” – “Public Holiday” – “Pay Leave and Non-pay leave Taken”

[/vc_toggle][vc_toggle title=”Normal Remuneration Vs Addition Remuneration”]

“Remuneration” means monthly fixed remuneration paid to an employee whether the amount is fixed or variable as stated in the employment contract written or otherwise.

If the employee has no salary and only receives a commission, the commission paid is considered as remuneration.

If the monthly salary is paid on a daily or hourly basis, the total monthly salary paid is considered as remuneration.

If the monthly salary changes due to the change in currency values, the total monthly salary paid is also considered as remuneration.

With effective from 1 January 2013, overtime allowance, allowances (variable amount paid monthly) and commission (variable amount paid monthly) are categorised as normal remuneration.

Only allowance and commission which not paid monthly are categorised as additional remuneration.

ADDITIONAL REMUNERATION

“Additional remuneration” means any payment paid to an employee either in one lump sum or periodical or in arrears or non fixed payment or any additional payment to a current month’s normal remuneration.

Such additional remuneration includes:

- i. bonus/incentive

- ii. arrears of salary or any other arrears paid to an employee

- iii. employee‟s share option scheme (if employee opts for MTD deduction)

- iv. tax borne by employer

- v. gratuity

- vi. compensation for loss of employment

- vii. ex-gratia

- viii. director‟s fee (not paid monthly)

- ix. commissions (not paid monthly)

- x. allowances (not paid monthly)

- xi. any other payment in addition to normal remuneration for current month

[/vc_toggle][vc_toggle title=”Type of Benefit-in-Kind and Perquisites that Exempt from Tax”]

AdvancedHot search: Million Software | UBS |POS | VPOS

Your Position: Home > FAQ > Payroll > Type of Benefit-in-Kind and Perquisites that Exempt from Tax

Type of Benefit-in-Kind and Perquisites that Exempt from Tax

Million System

[Large] [Medium] [Small]

PCB 2013

MTD is to be deducted from the employee’s taxable remuneration only. All the tax exemption on allowances, benefit-in-kind and perquisites shall be excluded from the remuneration for MTD purposes. Any amount exceed the restricted amount shall be taxable. Please refer to table below:-

All the tax exemption on allowances, benefit-in-kind and perquisites shall reported in the EA Form, section G

– TOTAL TAX EXEMPT ALLOWANCES / PERQUISITES / GIFTS / BENEFITS. (Effective in Year 2013)

Type of benefit-in-kind and perquisites that exempt from tax are as follows:

| Allowances / Perquisites / Gifts / Benefits | Restricted amount (RM) | |

| a. | Petrol card, petrol allowance, travelling allowance or toll payment or any of its combination for official duties.

If the amount received exceeds RM6,000 a year, the employee can make a further deduction in respect of the amount spent for official duties. Records pertaining to the claim for official duties and the exempted amount must be kept for a period of 7 years for audit purpose. |

RM 6,000.00 |

| b. | Child care allowance in respect of children up to 12 years of age. | RM 2,400.00 |

| c. | Gift of fixed line telephone, mobile phone, pager or Personal Digital Assistant (PDA) registered in the name of the employee or employer including cost of registration and installation. | Limited to only 1 unit for each category of assets |

| d. | Monthly bills for subscription of broadband, fixed line telephone, mobile phone, pager and PDA registered in the name of the employee or employer including cost of registration and installation. | Limited to only 1 line for each category of assets. |

| e.

|

Gift of new personal computer (one unit). „Personal computer. means a desktop computer, laptop computer and handheld computer but does not include a hand phone with computer facilities. [ P.U. (A) 191/2008].

|

Limited to 1 unit

only (up to Y/A 2010 only)

|

| f.

|

Perquisite (whether in money or otherwise) provided to the employee pursuant to his employment in respect of:-

(i) past achievement award; (ii) service excellence award, innovation award or productivity award; and (iii) long service award (provided that the employee has exercised an employment for more than 10 years with the same employer).

|

2,000

|

| g.

|

Parking rate and parking allowance. This includes parking rate paid by the employer directly to the parking operator.

|

Restricted to the

actual amount expended

|

| h.

|

Meal allowance received on a regular basis and given at the same rate to all employees. Meal allowance provided for purposes such as overtime or outstation / overseas trips and other similar purposes in exercising an employment are only exempted if given based on the rate fixed in the internal circular or written instruction of the employer.

|

Restricted to the

actual amount expended

|

| i.

|

Subsidised interest for housing, education or car loan is fully exempted from tax if the total amount of loan taken in aggregate does not exceed RM300,000.

If the total amount of loan exceeds RM300,000, the amount of subsidized interest to be exempted from tax is limited in accordance with the following formula : A * B/C Where;

A x B/C

A = is the difference between the amount of interest to be borne by the employee and the amount of interest payable by the employee in the basis period for a year of assessment;

B = is the aggregate of the balance of the principal amount of housing, education or car loan taken by the employee in the basis period for a year of assessment or RM300,000, whichever is lower;

C = is the total aggregate of the principal amount of housing, education or car loan taken by the employee. |

Example : Normal remuneration : RM5,000 per month

Car allowance : RM 800 per month

Meal allowance : RM 300 per month(Exempted)

Childcare allowance : RM 300 per month(Exempted – limit to RM2,400 per year)

Total : RM6,400 per month

To determine MTD amount, taxable income as follow:

Normal remuneration : RM5,000 per month

Car allowance : RM 800 per month

Childcare allowance : Taxable on allowance > RM2400 during the year.

Total taxable remuneration : RM 5,800 per month

Download here for more detail on exempt benefit-in-kind and perquisites

ALLOWANCE NOT EXEMPTED

- PHONE ALLOWANCE

Where an employee receives a fixed allowance for telephone, the full amount of that telephone allowance is taxable as part of his gross income from employment under paragraph 13(1)(a) of the ITA 1967.

[/vc_toggle][vc_toggle title=”What is the responsible of an employer?”]

An Employer is responsible to:-

- i. to submit a TP3 Form to the employer to notify information relating to his employment with previous employer in the current year.

- ii. to submit a TP1 Form to the employer if employee wishes to claim deductions and rebates in the relevant month. The deductions and rebate will be effected subject to approval by employer.

- iii. to submit a TP2 Form if employee wishes to include benefits in kind (BIK) and value of living accommodation (VOLA) as part of his monthly remuneration in ascertaining the MTD amount subject to approval by employer.

- iv. to keep and retain in safe custody each and every receipt relating to claims of deductions for a period of seven years from the end of that year of assessment under the Act.

- v. to furnish complete and accurate personal information and update any changes of his personal particulars to the employer.

- vi. to furnish correct information in a prescribed form relating to his own chargeability to tax and failure by the employee to do so constitutes an offence under paragraph 113(1)(b) of the Act.

Direct From: – http://www.hasil.gov.my/goindex.php?kump=5&skum=3&posi=1&unit=5100&sequ=6

[/vc_toggle][vc_toggle title=”How to determine employee category in Million Payroll?”]

Employee Category

Schedule of Monthly Tax Deductions and the Computerised Calculation Method classifies employee into 3 categories:

Category 1 : Single

Category 2 : Married and spouse is not working

Category 3 : Married and spouse is working

Category 3 of the Schedule of Monthly Tax Deductions or the Computerised Calculation Method is applicable where an employee is divorced, widowed or a single (with adopted children).

Where a wife who elects to claim all child deductions, her MTD is ascertained under Category 3 (KA1 – KA20) while MTD for the husband is ascertained under Category 3 (K).

Where a husband and wife elect to claim deduction for certain child, MTD for husband and wife is ascertained under Category 3 (KA1 – KA20).

Example :

A working husband and wife with 5 children. The husband claims child deduction for their 3 children and the wife claims for the remaining 2 children. MTD is ascertained as follows:

Husband – Category 3 (KA3)

Wife – Category 3 (KA2)

MTD is ascertained under Category 3 (KA1 – KA20) for an employee who is single with an adopted child.

Direct From:- http://www.hasil.gov.my/goindex.php?kump=5&skum=3&posi=1&unit=5100&sequ=6

[/vc_toggle][vc_toggle title=”How Socso works in Malaysia?”]

| Social Security Organisation (SOCSO), officially known as Pertubuhan Keselamatan Sosial (PERKESO), is an organization that was established in 1971 under the Ministry of Human Resources (formerly known as Ministry of Labor) in order to provide social security protection to employees via social insurance. Protection includes:

|

|

| · medical and cash benefits for any employee who is involved in a work-related accident, commuting accident, or has an occupational disease;

· provision of artificial aids and rehabilitation to employees to reduce the sufferings; and · provision of financial guarantees and protection to the family.

|

|

| SOCSO undertakes to pay, amongst others:

|

|

| · temporarily disability benefits within 7 days of receipt of all required documents;

· permanent disability benefits within 14 days; · funeral expenses within 3 days; and · benefits to families of the deceased within 14 days.

|

|

| 2. Categories of employees covered by SOCSO: SOCSO only covers Malaysian workers and permanent residents earning less than RM2,000 a month, regardless of age or whether their employment status is permanent, temporary, or casual in nature. However, it specifically excludes:

|

|

| · A person whose wages exceed RM2,000 a month, unless they have already been covered before;

· Government employees; · Domestic servants employed to work in a private dwelling house, e.g. house servants, cooks, washer woman, gardeners, or driver; · Employees who have reached the age of 55 (if they continue to work, they should be covered under the Employment Injuries Scheme); · Self-employed persons; and · Foreign workers (they should be covered under the Workmen’s Compensation Act 1952.)

|

|

| 3. SOCSO’s definition of ‘wages’: For the purpose of SOCSO contribution, wages mean all remuneration payable in money to an employee:

|

|

| · salary;

· overtime payment; · commissions and service charge; · payment for leave, whether sick leave, annual leave, rest day, public holidays, maternity, or others; and · allowances, e.g. shift allowance, incentive, housing, food, or cost of living. Payments made to an employee, based on task or piece rate, are also considered as wages.

|

|

| However, the following payments are not considered as wages:

|

|

| · mileage claims;

· payments to the Employees Provident Fund (EPF) or other statutory funds; and · gratuity payments or payments for dismissal or retrenchment; and · annual bonus. |

|

This Article Direct from http://malaysiafactbook.com/SOCSO

[/vc_toggle][vc_toggle title=”WHAT IS THE COVERAGE PROVIDED TO AN INSURED PERSON BY SOCSO”]

WHAT IS THE COVERAGE PROVIDED TO AN INSURED PERSON BY SOCSO UNDER ESSA 1969 ?

An insured person or dependants will be entitled to the following benefits :

- Periodical payments in the case of invalidity

- Periodical payments in the case of disablement suffered as a result of an employment injury

- Periodical payments to the dependants of an insured person who dies as a result of an employment injury

- Payments for funeral benefit or expense on the death of an insured person as a result of an employment injury

- Periodical payments to an insured person who is in receipt of invalidity pension or disablement benefit and is so severely incapacitated or disabled as to require the personal attendance of another person

- Medical treatments for the attendance on insured persons suffering from disablement

- Periodical payments to dependants of an insured person who dies while in receipt of invalidity pension

SOCSO provides coverage to eligible employees through 2 schemes namely

- Employment Injury Insurance Scheme

- Invalidity Pension Scheme.

These schemes are classified into 2 categories :

- First Category – Employment Injury Insurance Scheme and Invalidity Pension Scheme. The contribution payment is made by both the employer and employee

- Second Category – Employment Injury Insurance Scheme Only. The contribution is paid by the employer only. An employee who is not eligible for coverage under the Invalidity Pension Scheme is protected under this category.

These schemes provide the benefits of invalidity pension, invalidity grant, survivors pension, rehabilitation, funeral benefit, constant attendance allowance and educational loan.

[/vc_toggle][vc_toggle title=”Payment Liable for EPF Contribution”]Payment Liable for EPF Contribution

In general, all payments which are meant to be wages are accountable in your monthly contribution amount calculation. These include:

- Salary

- Payment for unutilised annual or medical leave

- Bonus

- Allowance

- Commision

- Incentive

- Arrears of wages

- Wages for maternity leave

- Wages for study leave

- Wages for half day leave

- Other payments under services contract or otherwise

Source : http://www.kwsp.gov.my/portal/en/member/member-responsibility/contribution/payments-liable-for-epf-contribution[/vc_toggle][/vc_tta_section][vc_tta_section title=”Remote Desktop” tab_id=”1541400797809-c2c13c29-0a6b”][vc_toggle title=”Unable to login using remote Desktop”]You may try flushdns in this case

download the here[/vc_toggle][/vc_tta_section][vc_tta_section title=”SQL Script” tab_id=”1541400851845-82aa9c09-ed96″][vc_toggle title=”SQL Script – Calculate Due Date”]Script #1

Last day of Due date month

Update ARInvoice

Set DueDate = DateAdd(day, -1, DateAdd(month, 5, DateAdd(day, 1 – day(Docdate), DocDate)))

Where DisplayTerm = ’60 NETT’

Script #2

Number of days calculate from last day of invoice date

Update ARInvoice

Set DueDate = dateadd(day, -1, dateadd(month, 1, dateadd(day, 1 – day(Docdate), DocDate))) + 120

Where DisplayTerm = ’60 NETT'[/vc_toggle][/vc_tta_section][vc_tta_section title=”Stock & Invoicing” tab_id=”1541400908660-f9a4299a-da4e”][vc_toggle title=”Why Invoice Amount & Quantity Show as Esteric “****“ ?”]Million invoice sometimes may show as esteric when your amount or quantity on invoice too large.

To solve the esteric problem you require to do some report customization:-

{go to} Print => Customize

1. Change to smaller font size.

2. Change to more narrow font type.

3. Extend the length of character field

4. Change the field format.

[/vc_toggle][vc_toggle title=”How to maintain Multi UOM in Million Software?”]

[/vc_toggle][vc_toggle title=”How to maintain Multi UOM in Million Software?”]

After key in all UOM, then click “ok” to exit.[/vc_toggle][/vc_tta_section][vc_tta_section title=”Why Choose Million Software” tab_id=”1543029290493-4b457939-efdc”][vc_column_text]Click To View More Details[/vc_column_text][/vc_tta_section][/vc_tta_accordion][/vc_column][/vc_row]